The short answer: Yes, domain investing works in 2026 if you have data.

No, if you're guessing.

The domain aftermarket moved $2 billion last year and premium domains still sell for six figures. The domain aftermarket still moves billions of dollars annually, and premium domains continue to sell for six figures.

A glance at the top domain sales of 2025 on Bishopi’s Sales History tool confirms this.

The market isn’t dying but it has changed.

Institutional investors now rely on algorithms, comparable sales databases, and trend analysis. Meanwhile, many individual investors still operate on intuition.

That intelligence gap explains why roughly 97% of registered domains never sell.

In 2026, domain investing rewards precision, not volume.

Why Is Domain Investing Different in 2026?

By Q3 2025, over 375 million domains were already registered. Every obvious opportunity is gone.

A few years ago, you could register dozens of names and hope a few were sold. Today, that strategy produces portfolios full of renewal fees and zero exits.

The market has shifted from speculation to selection.

Success now requires:

Comparable sales and demand data

Patient capital (2–5 year holding periods)

Quality over quantity

Understanding the numbers makes this shift unavoidable.

Domain Market Statistics: What’s Happening in 2026?

The data reveals a stable but intensely selective market where only informed investors consistently get a high ROI.

Metric | Reality |

Market size (2024) | |

Projected Growth (By 2033) | $3B+ |

Annual Sell-Through Rate | 1-3% |

Median Sale Price | $1,500-$3,000 |

Six-figure sales | <0.1% |

Typical holding period | 2-5 years |

What this means

Most domains won’t sell in any given year. Profits come from a few winners covering renewal costs across the portfolio.

Pricing expectations must align with median reality, not premium outliers.

Long holding periods turn domain investing into capital allocation, not flipping.

This is the market reality of domain investing in 2026 makes trend analysis and domain valuation tools essential.

How to Do Deep Domain Research in 2026

In 2026, domain investing is shifting from broad speculation to keyword-driven capital allocation.

Professionals focus on where demand persists—tracking which keywords consistently sell, at what prices, and with what momentum.

Specialized tools like Bishopi’s Domain Trends Tool support this approach by revealing which categories compound value over time, rather than relying on rare premium outcomes.

Source: Bishopi’s Domain Trends Tool

Top 3 Trends Driving Domain Value in 2026

Understanding the "why" behind current domain investor trends is the difference between an investment and a gamble.

The top 3 trends driving domain value in 2026 are:

1. .com Dominates, But Context Matters

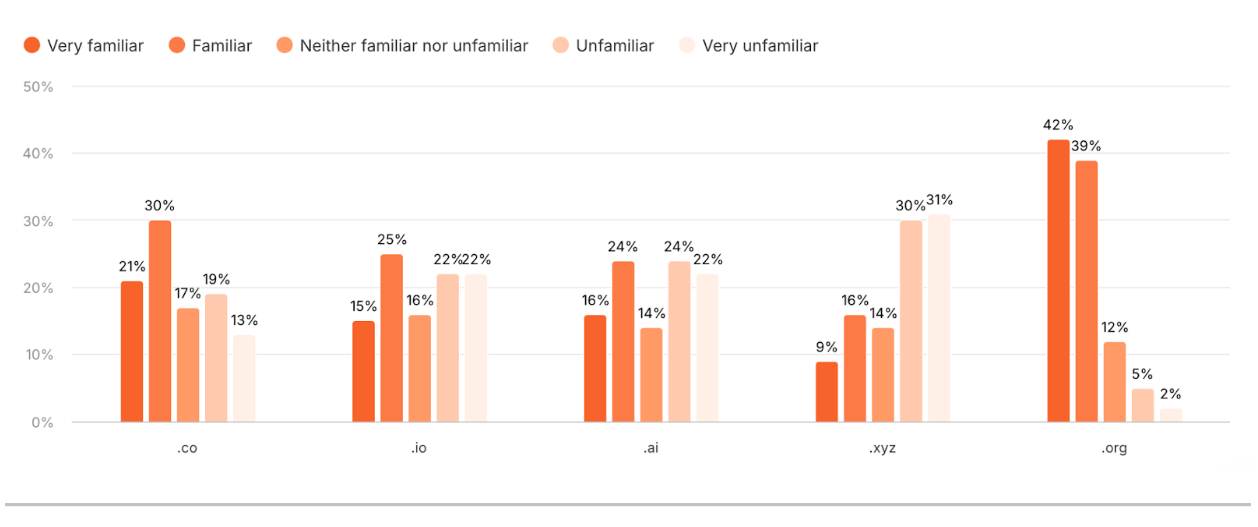

.com is still overwhelmingly more familiar than other domain extensions. That said, the right domain extension for your business depends on the overall context.

Source: atom.com

The smart strategy while picking a domain name is to match it to specific use cases:

.ai → AI startups (signals category credibility)

.io → Tech companies (established convention)

.de → German businesses (local trust beats .com)

If you’re a German consulting firm, it makes more sense to pay more for the right .de domain than a mediocre .com because it signals local presence.

Don't buy extensions speculatively. Match them to verified end-user demand.

2. AI Keywords: Specificity Wins

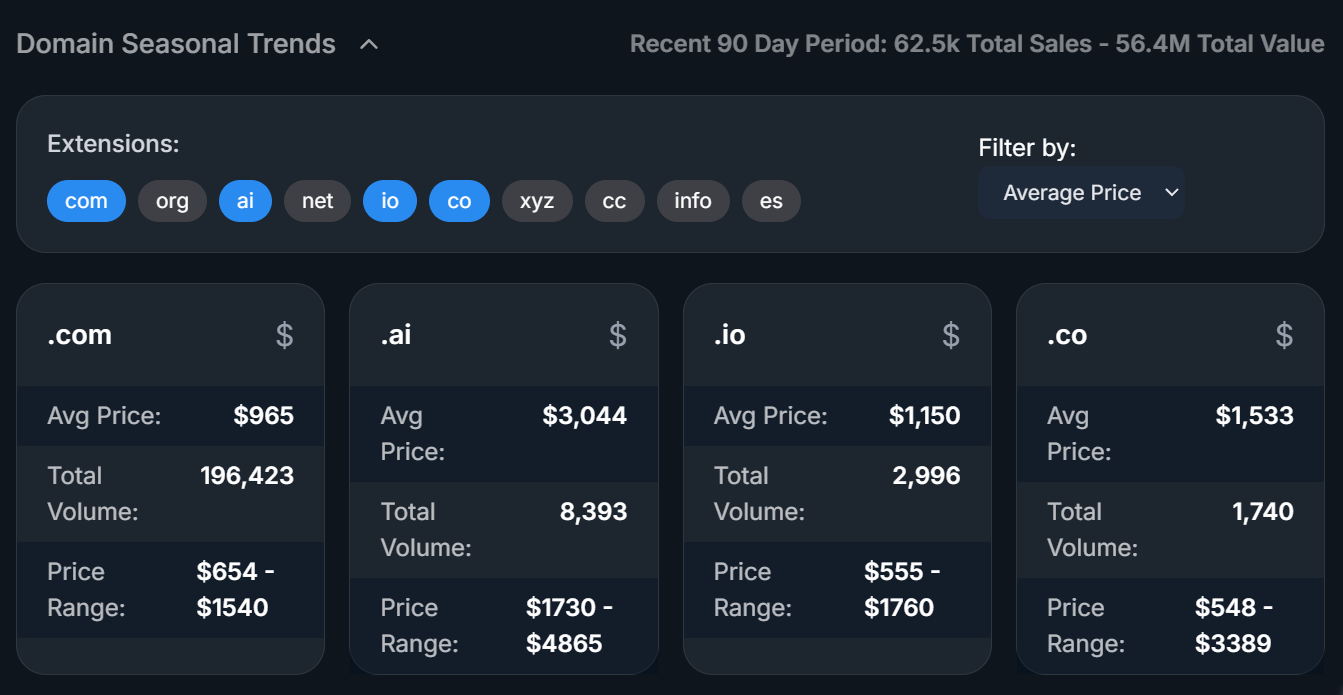

In the last 3 years, AI domains saw 3-5x price increases. In fact, seasonal trends show that the average price is over 3x higher than other extensions.

[Source: Bishopi’s Domain Trends tool]

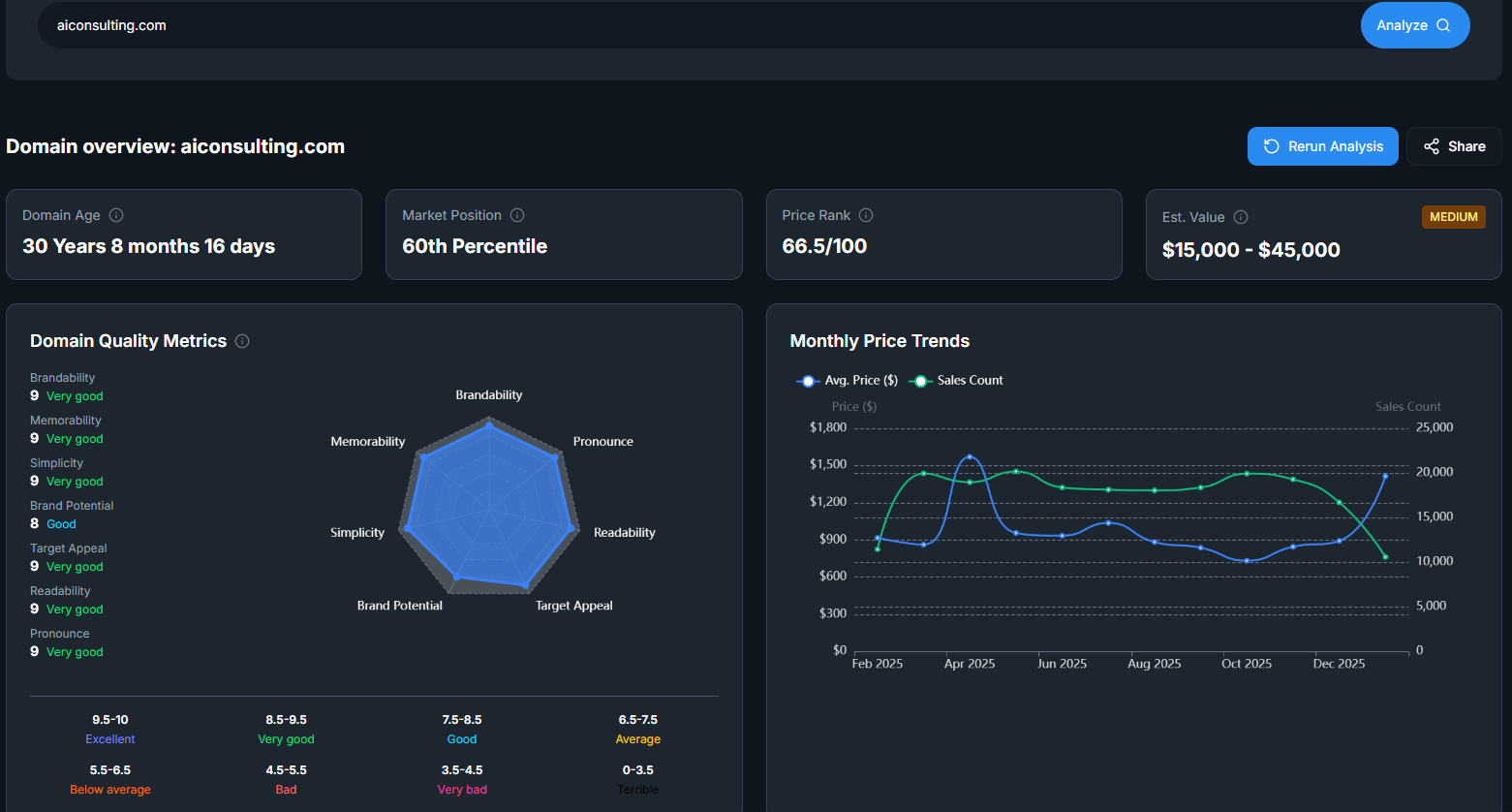

So while it’s a good choice to make, understand the difference between a high-value domain and a lower one.

High-value: aiconsulting.com (listed at $2,50,000)

Average-value: aiaspect.com (listed at $3,349)

The difference? One describes an actual service businesses need. The other is a buzzword with low commercial utility.

This pattern repeats across every trend cycle. Blockchain, Web3, metaverse - buzzword combinations spike then crash. Domains describing real services hold value.

Rule: Buy domains that solve business problems, not domains that sound trendy.

3. Follow Business Formation Data

The best-performing investors position where companies are actually forming.

Categories that consistently sell:

Industry-specific: realtors.com

Geographic: Plumberaustin.com

Business models: Bookingplatform.com

Pick one of these categories and then track business registrations, funding data, and regulatory shifts. Position yourself where such companies are launching to get a good return.

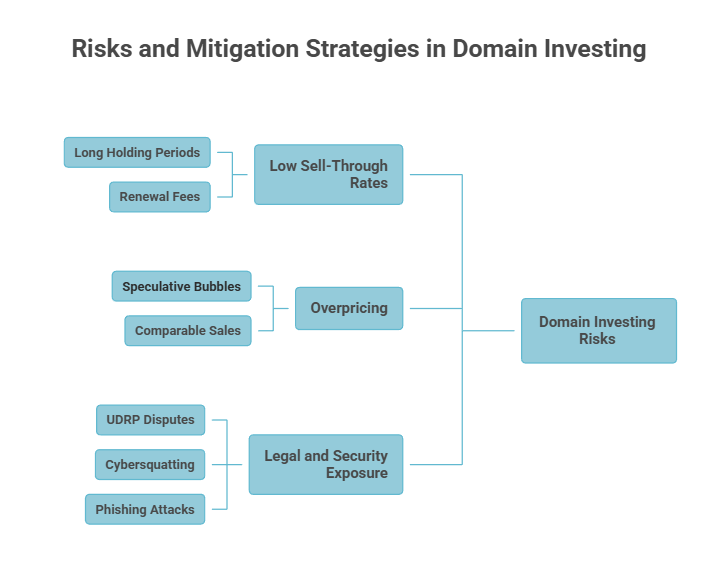

3 Real Risks You Need to Understand Before Investing in Domains

To be successful in domain investing, you need to understand the risk before making any decisions.

1. Low Sell-Through Rates and Long Holding Periods

Only 1–3% of listed domains sell each year, and most quality domains require 2–5 years to find the right buyer. If you hold a portfolio of 20 carefully chosen domains, expect to sell 1–2 per year. The rest will keep accruing renewal fees while you wait.

Mitigation: Build your portfolio math into your strategy. For example, a $10,000 sale must cover 3-4 years of renewal fees across the portfolio just to break even.

Your second and third sales are when real returns start to appear.

2. Overpricing and Speculative Bubbles

Many new investors overprice domains after seeing premium sales, assuming their names are worth the same.

The problem: overpriced domains sit unsold for years, compounding renewal costs without generating returns.

Mitigation: Base pricing on actual comparable sales over the past 18–24 months, not outliers or asking prices. Platforms like Bishopi.io provide reliable transaction data.

When trends emerge (like AI), focus on domains with sustained demand, not hype.

For example:

HealthcareAI.com → lasting utility

AIRevolutionBlockchainWeb3.com → speculation stacked on speculation

3. Legal and Security Exposure

Registering domains too close to trademarks can trigger UDRP disputes. Cybersquatting—deliberate misspellings or brand confusion—can bring fines or legal judgments.

On top of that, domain accounts are frequent phishing targets; losing access can mean losing your entire portfolio.

Mitigation:

Perform trademark searches before registering (check WHOIS database on Bishopi)

Avoid brand-adjacent or misspelled domains

Use 2FA, registry locks, and secure email

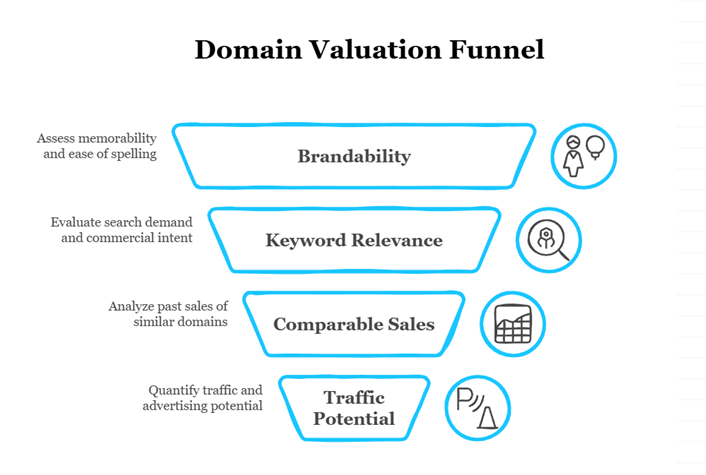

What Makes Domains Valuable: Four Key Criteria

Not all domains are created equal. Successful investors consistently rely on four characteristics to predict whether a domain will sell and at what price.

These criteria form the foundation for a disciplined evaluation framework and help you avoid overpricing and speculative bubbles.

1. Brandability Beats Keyword Stuffing

A domain should be memorable and easy to spell, even after hearing it once over the phone.

Works: Zoom.us – short, catchy, brandable

Fails: VideoConferencingSolution.com – keyword-heavy but forgettable

Specificity wins, while buzzword-heavy combinations often fail. If a domain isn’t easily brandable, it won’t attract buyers, no matter how many keywords it contains.

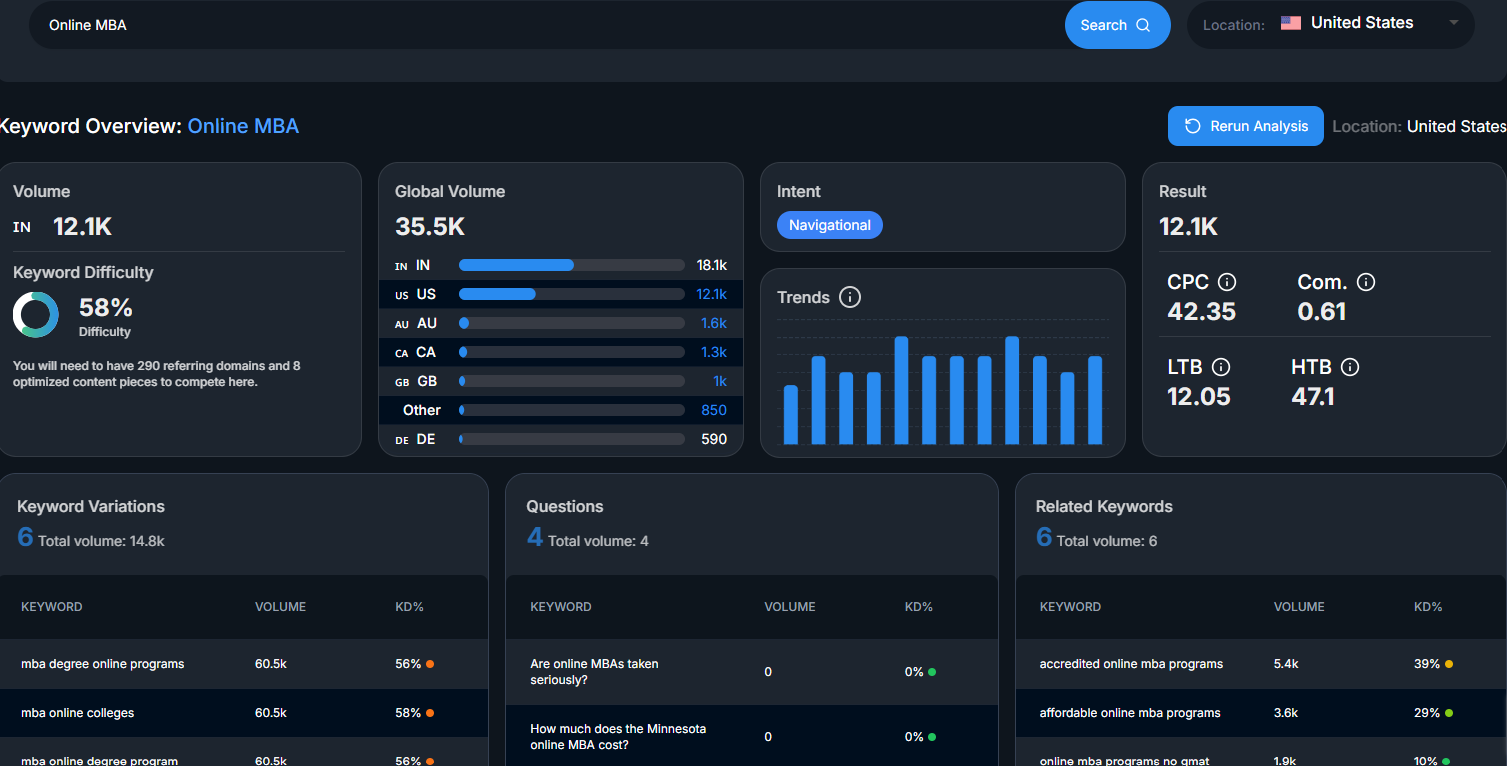

2. Keyword Relevance Requires Actual Search Demand

A domain’s value depends on whether people actually search for it, and if that search shows commercial intent.

With Bishopi’s keyword research tool, you can gain insights into search volume for any specific region.

Credit: Bishopi Keyword Reaserch tool

Works: PlumberAustin.com – real searches from people looking to hire

Fails: BestTopRatedPlumberServicesAustin.com – unreadable, unmemorable, and not how people search

This principle drives the business formation strategy: domains only have value when they match both how businesses describe themselves and how customers search for them.

3. Comparable Sales Ground Expectations in Reality

What have similar domains sold for in the past 18–24 months?

If comps show $5K–$8K, expecting $25K is unrealistic.

Without comparable sales data, you’re guessing - and likely guessing too high.

Using transaction data prevents overpricing and ensures your portfolio remains liquid.

4. Traffic Potential Can Be Quantified

Type-in traffic and exact-match keyword searches provide tangible value.

500 monthly visitors = measurable advertising potential

Zero traffic with declining search volume = speculation

Tools like Bishopi.io help quantify traffic and demand, turning subjective assumptions into data-driven decisions.

How to Evaluate Domain Names Before Buying

Success comes from smarter decisions, not bigger bets. Use this checklist to make every purchase data-driven:

Step | What to Check | Why It Matters |

Comparable Sales | What similar domains actually sold for (not asking price | Prevents overpricing, validates brandability and keyword relevance |

Search Trends | Is search volume rising or falling? | Ensures the domain aligns with real, growing demand |

Brandability | Is the name memorable, easy to spell, and clear? | Hard-to-remember domains sell poorly despite keyword stuffing |

Total Cost | Purchase price + 3-5 years of renewals | Avoids hidden long-term costs and ensures ROI potential |

Traffic Potential | Type-in traffic or exact-match search traffic | Quantifies commercial value; low traffic = speculation |

Following this framework gives you the same data-driven edge as professionals, reducing guesswork and improving portfolio performance.

Quick Tip: A fast and reliable way to check all these metrics is Bishopi’s Domain Value Analysis tool.

With a simple search, it evaluates domains based on keyword relevance, market trends, brandability, traffic potential, and comparable sales - giving you data-backed confidence before making a purchase.

4 Domain Investing Strategies That Work

Success in domain investing comes from precision, timing, and real demand, not volume. Between 2023–2025, investors who followed these approaches consistently saw results.

Focus on Quality Over Quantity

Prioritize a smaller portfolio of highly brandable, memorable, premium domains rather than keyword-stuffed registrations. As digital real estate grows scarcer, top-tier names continue to appreciate.

A single strong domain can deliver outsized returns compared to dozens of average ones, with lower renewal overhead and faster liquidity.

Recent examples:

icon.com - $12,000,000 (2025)

commerce.com - $2,200,000 (2025)

fuse.com - $2,129,509 (2025)

Combine Geography with Service

Target local businesses by pairing a city/region with a high-intent service keyword. These deliver instant SEO advantages, local credibility, and predictable buyer interest.

Lower competition, clearer end-user intent, and reliable mid-five-figure exits make this one of the lower-risk plays.

Recent examples:

supplychaintexas.com - ~$22,000 (2025)

financialplannerphoenix.com - mid-five figures (2024–2025 range)

Time Emerging Industries

Position early in fast-growing sectors before mainstream adoption drives up competition and prices. Track funding rounds, business formations, and tech shifts to anticipate demand.

Early entry captures lower acquisition costs and higher multiples when the industry matures.

Recent examples:

chatbot.io - $50,000 (2023, early AI wave)

aianalytics.io - five figures (2025)

quantumcomputingsoftware.com - $5K to $15K range (2024-2025)

Use Context-Driven Extensions

Select TLDs that signal niche expertise or regional trust (.ai for AI, .io for tech, ccTLDs for local markets). These extensions add credibility and match buyer expectations in specific verticals.

Buyers increasingly pay premiums for extensions that align with industry conventions or geography, boosting perceived value and sell-through.

Recent examples:

cloud.ai — $600,000 (2025)

fin.ai — $1,000,000 (2025)

game.ai — five figures (2024–2025); similar strong .ai and ccTLD sales like cloudsoftware.de in €6K–€12K range

The Bottom Line

Domain investing is alive and thriving in 2026 but only for those who approach it as strategic, data-backed asset acquisition.

Every trend points the same direction: more transparency, more data-driven decisions, more sophisticated buyers.

If you're serious about profiting in this mature, selective space, the path is straightforward: ditch the lottery-ticket mindset and commit to data-driven investing.

Arm yourself with real metrics - comparable sales from the last 18–24 months, verified search trends, business formation signals, traffic potential, and brandability scores - before every registration or purchase.

Explore Bishopi’s domain valuation tools

Frequently Asked Questions

Is buying domains a good investment?

It can be, but only if you're willing to hold for 2-5 years and make decisions based on real data, not hunches. If you need your money back quickly or you're guessing at values, skip it.

How does a small investor invest in domain names?

Start small - $500-1,000 for 5-10 carefully chosen domains. Use Bishopi.io to check what similar domains actually sold for and verify search demand before you buy. Your edge is making smarter picks, not buying more domains.

Is it worth paying for a premium domain?

Pay up when the data backs it - strong brand potential, rising search trends, solid comparable sales, and real traffic. But if you're just hoping it'll be valuable someday, walk away.

Originally published at: www.bishopi.io

Get updated with all the news, update and upcoming features.