Domain Name Trends in 2026 Nobody Saw Coming

After closely tracking how domain names actually traded in 2025, one market signal becomes clear.

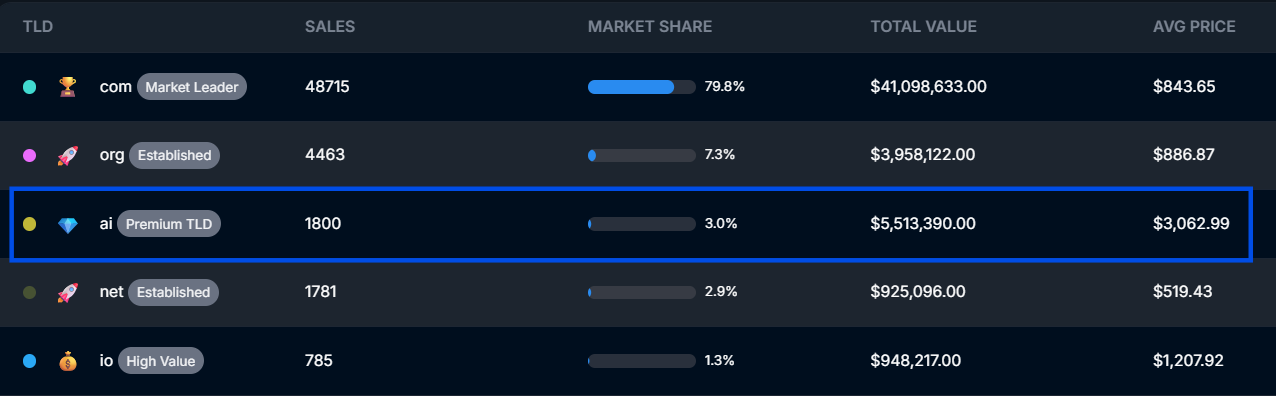

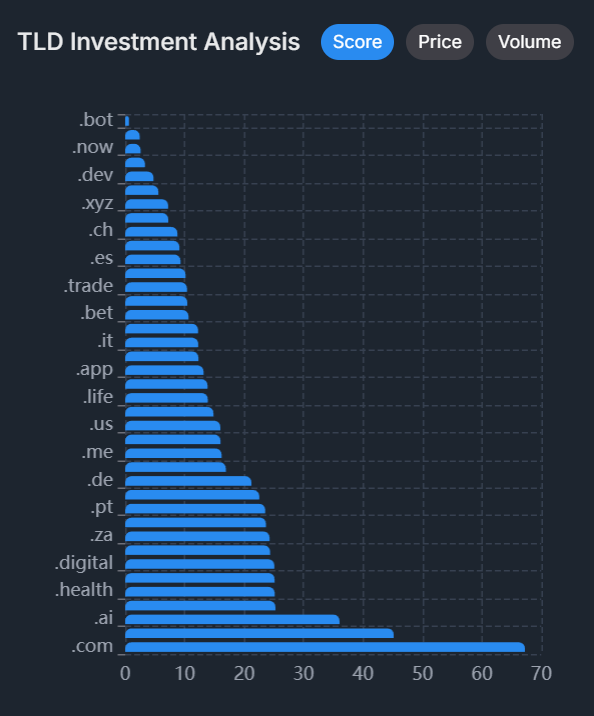

.com continues to dominate domain sales.

Nearly 80% of all aftermarket transactions still happen on .com. It remains the default for trust, familiarity, and global scale.

That hasn’t changed.

What has changed is where incremental value is forming.

[Source: Bishopi’s Domain Trends Tool]

.ai is catching up - not in volume, but in value. It now holds roughly 3% of total market share, yet commands some of the highest average sale prices in the aftermarket.

That's the definition of a premium TLD: fewer sales, higher conviction, and buyers who know exactly why they're paying more.

This split sets the tone for 2026.

Going into 2026, the domain market rewards:

scale through proven extensions, and

precision through intent-driven domains.

Together, these signals define the domain market heading into 2026.

Key Domain Name Trends for 2026

The following trends translate these signals into practical investing patterns. Each reflects where demand is concentrating and how disciplined investors can position ahead of it.

Trend #1: AI-Assisted Domain Discovery

In 2026, good domain ideas are abundant.

AI tools like ChatGPT, Gemini, and Grok now ideate, shortlist, and suggest domains faster than any human brainstorm.

But remember: AI generates possibilities based on patterns, not proof of commercial viability.

But AI doesn't tell you:

If anyone actually searches for those terms

Whether the SERP is dominated by billion-dollar brands

If similar domains sell in the aftermarket

What comparable sales prices look like

That leads to a common mistake: registering AI-generated domain ideas simply because they sound good.

➡️Key Takeaway: AI is useful for ideation, not validation.

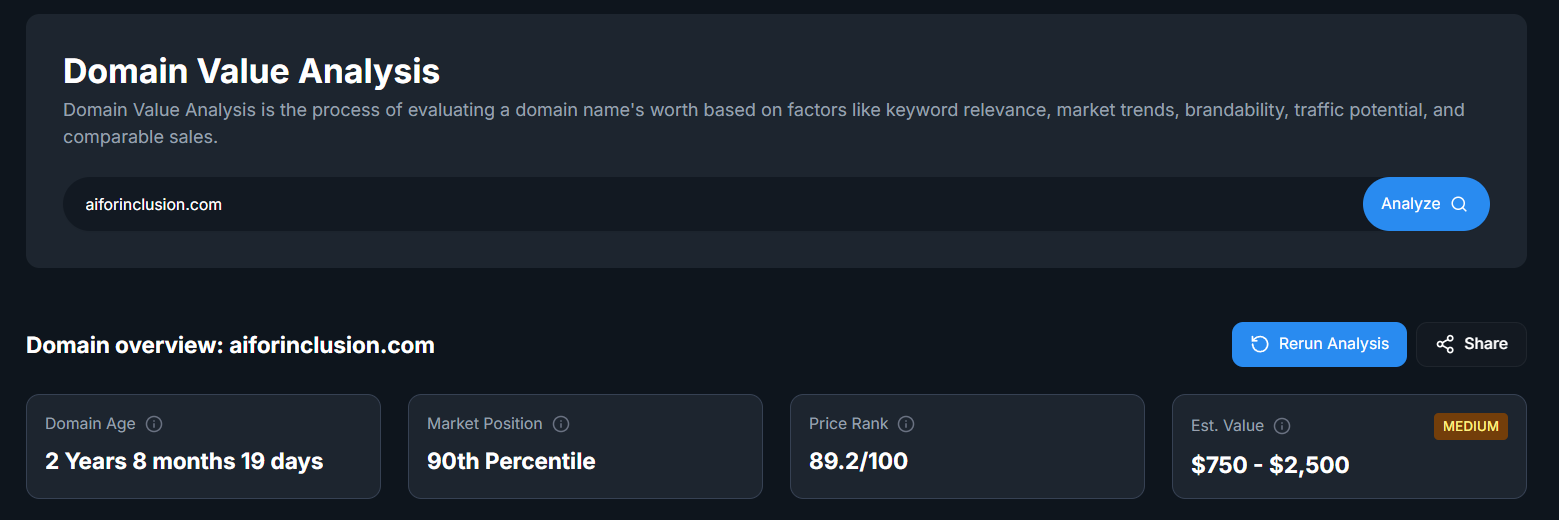

Before you purchase a domain name, validate it using Bishopi’s domain value analysis tool.

If the domain is already taken, you can see key details at a glance - its age, estimated value, and historical signals that indicate whether it’s been held as an asset or simply parked.

[Screenshot via Bishopi’s Domain Value Analysis Tool]

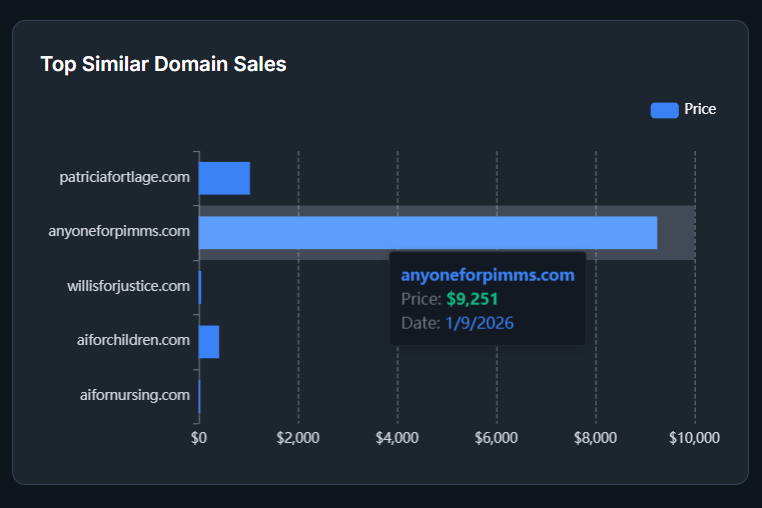

You can also review similar domain sales and past sale prices, which helps you understand how the market has priced comparable names.

That context makes it easier to decide whether a domain is fairly valued, overpriced, or worth pursuing at all.

[Screenshot via Bishopi’s Domain Value Analysis Tool]

Trend 2: Short, Brandable Domains Continue to Win

Short domains win because people remember them.

As markets get more crowded, recall matters more than description. Domains that are easy to say, spell, and recognize travel faster-through word of mouth, ads, and search results.

This is why many modern companies avoid long, keyword-heavy names. A domain that tries to explain everything often does the opposite: it slows understanding and weakens trust.

Examples that work:

Stripe

Notion

Airtable

Examples that don't work:

The difference shows up in better recall after hearing once, easier spelling and typing, higher perceived professionalism, and cleaner visual branding across platforms.

Recent sales confirm this pattern:

Looking at actual 2026 transactions, short brandables commanded high prices. And this pattern holds across price tiers.

Even mid-market sales favor brevity and brandability over length and exact keyword matching.

[Source: Bishopi’s Sales History Tool]

Finding your edge in short brandables:

Short brandable domains are competitive but they’re not random. The winners usually pass a few simple tests.

Check length: Aim for 10 characters or fewer. Anything longer starts to hurt recall.

Test pronounceability: Say the name out loud once. If it feels awkward or forces you to slow down, that friction will show up for users too.

Test spelling: Tell the name to someone verbally and ask them to spell it. If they hesitate or ask for clarification, that’s a signal.

Check market behavior: Look at whether similar-length domains in your niche are actually selling. Short names matter only if buyers are paying for them.

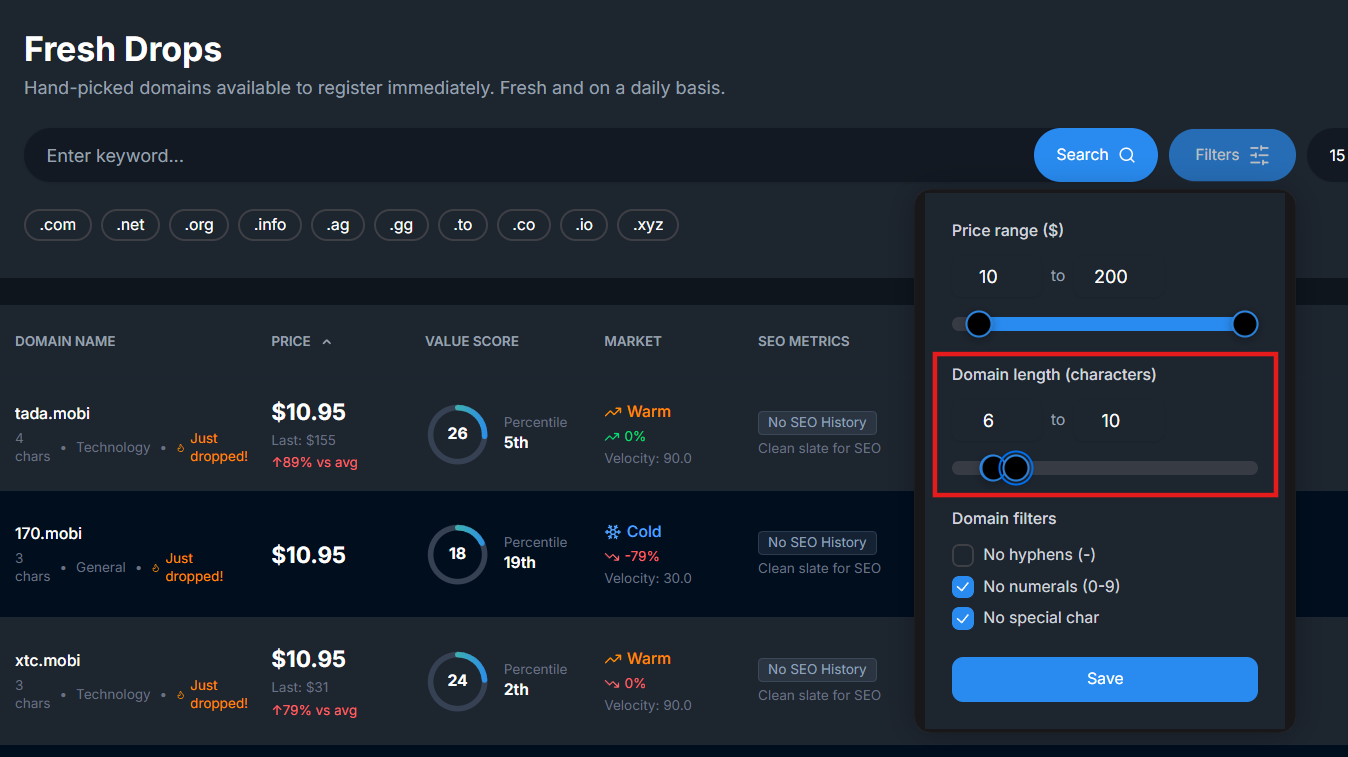

How to Filter for Available Short, Brandable Domains

Once you know what you’re looking for, filtering becomes easy.

On Bishopi’s Fresh Drops, you can:

filter domains by length (set it to under 10 characters),

narrow results by price range,

and surface freshly available domains that already meet brandability criteria.

[Screenshot via Bishopi’s Fresh Drops]

This approach shifts the work from endless searching to structured elimination, so you spend time evaluating good domains instead of scanning thousands of weak ones.

Trend #3: .com Still Leads, But Strategy Determines ROI

As we discussed earlier - .com is still the most trusted extension on the internet.

It dominates by volume, credibility, and default behavior. When people hear a brand name, they still assume the website ends in .com.

That advantage hasn’t disappeared.

What has changed is the cost of relying on it blindly.

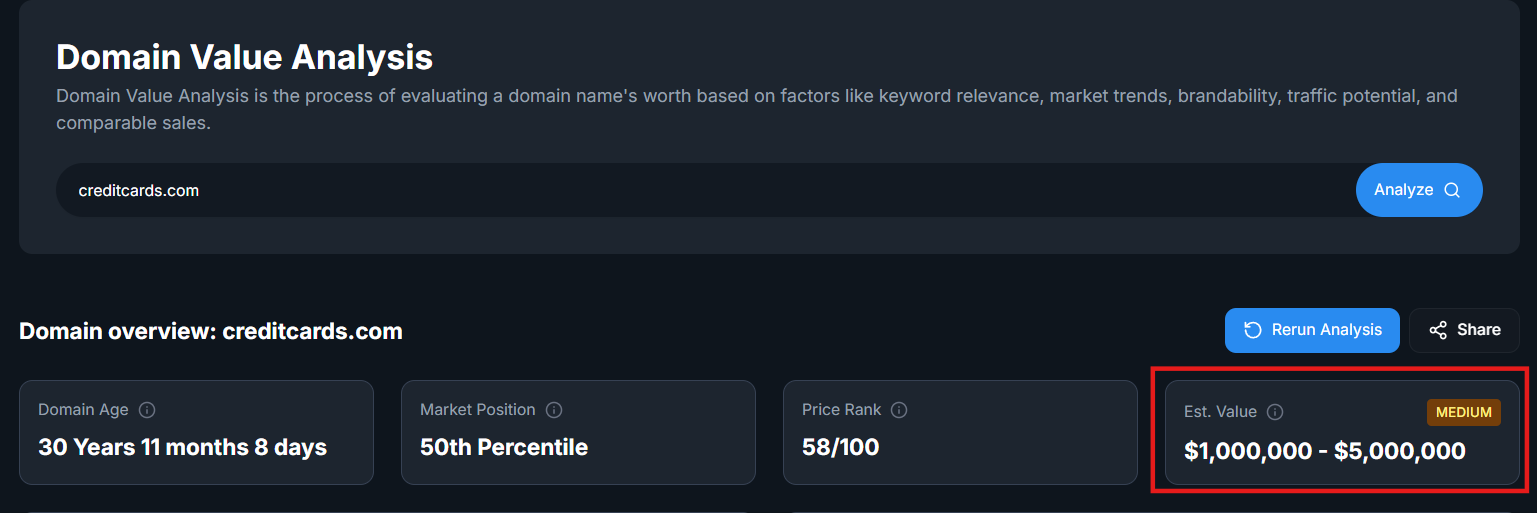

A domain built around a term like CreditCards.com will always sit at a premium. The demand is proven, buyer intent is clear, and comparable sales support the price.

The estimated cost is huge - somewhere between $1M - $5M.

[Screenshot via Bishopi’s Domain Value Analysis Tool]

But most buyers don’t need to compete at that level.

When .com Doesn’t Make Sense

Before paying a premium for a .com, ask yourself three questions:

No. | Question | What to Check | Implication |

1. | Is demand proven? | Stable search + buyer intent | Early demand = longer hold for .com |

2. | Can you compete? | Incumbents + SERP strength | Dominated SERP limits upside |

3. | Does the audience expect .com? | Category extension norms | .ai/.io/.tech may fit better |

If the answer is no to any of these, a premium .com is usually the wrong starting point. The smarter move is to choose a domain that matches current demand, not assumed prestige.

Trend #4: Niche & Industry gTLDs Gain Adoption

As .com gets expensive, other niche and industry domains gain traction.

[Screenshot via Bishopi’s Domain Trends Tool]

New generic top-level domains like .tech, .shop, .store, and .design that signal industry alignment hit 37.8 million registrations with 13.5% year-over-year growth.

These extensions work when they match audience expectations and industry norms. They perform best when the extension matches how buyers already think.

Examples:

.tech → software companies, dev tools, SaaS

.shop → DTC brands, e-commerce stores

.store → retail, omnichannel brands

.design → creative studios, UX/UI agencies

.app → mobile-first products

.agency → marketing, PR, consulting firms

In these cases, the extension does part of the positioning work for the buyer. That reduces friction at the point of sale.

A clean, one-word brand in .tech or .shop might cost five figures as a .com. In an ngTLD, it can cost a fraction.

That price gap is the opportunity.

At the same time, it’s important to keep in mind that many ngTLDs have lower renewal rates. That signals:

Higher churn

More speculative registrations

Many short-term experiments that never reach scale

This matters because aftermarket demand follows real usage, not registrations.

➡ ️Key Takeaway: ngTLDs are not cheaper .coms.

They are industry-aligned assets that work only when the extension matches buyer expectations and proven demand.

If you track renewals, aftermarket sales, and end-user adoption, you build leverage. But if you chase volume or hype, you can usually get stuck holding inventory.

Trend #5: Local ccTLDs for SEO & Trust

Local ccTLD investing sits at the intersection of search visibility and buyer trust.

Businesses that compete in regional markets need to rank locally and look local, and country-code domains do both. Search engines favor them in country-level queries, while users read them as proof of geographic accountability.

That combination creates durable end-user demand.

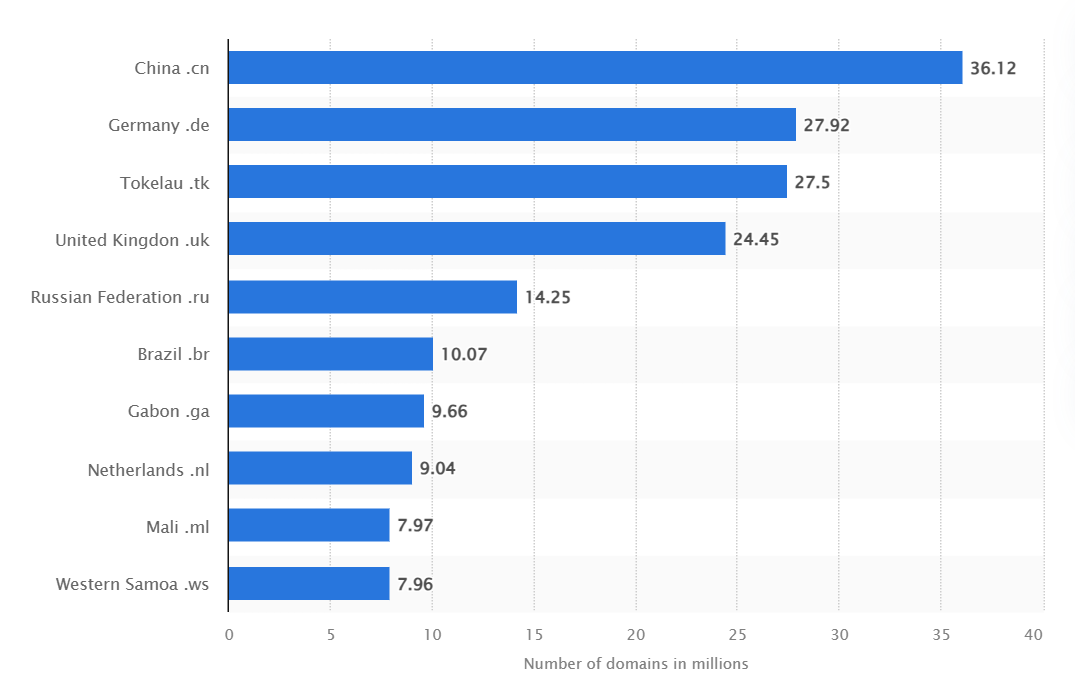

ccTLDs now account for over 324 million registrations globally, concentrated in mature economies where SMEs actively acquire premium keywords to capture regional traffic.

Take a look at the most active ccTLD markets:

[Screenshot via Statista]

Where investors see repeat demand:

China (.cn) → domestic e-commerce, tech platforms, manufacturing B2B

Germany (.de), UK (.uk) → B2B services, finance, agencies

Canada (.ca), Australia (.au) → e-commerce, professional services

➡️Key Takeaway:

Target generics in locally transacted services like legal, finance, trades, and agencies.

Track aftermarket comps and renewal economics before scaling.

Favor categories driven by local discovery over global branding

In mature markets, premium ccTLD keywords function like commercial locations: scarce, trust-driven, and repeatedly acquired by businesses that depend on local visibility.

Trend #6: Domains as Digital Identity Anchors

Domains are becoming the fixed point of a company’s digital identity. Everything else is rented. Social platforms change names, throttle reach, or suspend accounts with little warning.

A domain is the one asset a business fully controls.

It becomes the permanent address customers remember and the base layer for email, apps, and brand continuity.

That permanence matters more in an AI-saturated web. As synthetic content scales, companies lean on owned domains as a signal of authenticity.

You see that shift in behavior: startups now launch with small defensive portfolios, not single domains.

Many teams secure:

Core brand plus common misspellings

Singular and plural variants

Category keywords tied to positioning

Key ccTLDs for future expansion

For investors, this behavior creates steady defensive demand. Companies buy domains to reduce brand risk and control traffic, not to speculate.

Even large organizations follow this playbook.

Google has registered hundreds of typo and look-alike domains to block phishing and traffic leakage across its brands.

[Infographic made via Google Gemini]

➡️Key Takeaway:

Names with clear defensive value such as common misspellings and close variants solve real problems. Those domains are the ones that resell consistently.

Trend 7: Tech ccTLDs as Startup Infrastructure

Tech-native extensions have moved from novelty to default startup tooling. Founders choose them to launch faster, secure cleaner names, and signal category fit when .com is unavailable or overpriced. Demand is concentrated in a small set of extensions with active resale liquidity.

Extensions with consistent startup demand

.ai → AI companies, developer tools, data platforms

.io → SaaS products, infrastructure, dev ecosystems

.co → venture-backed startups and consumer tech

.tech → product-led and hardware startups

.app → mobile-first software products

For investors, this is a working market, not a trend trade. Liquidity comes from founders buying usable brandables and category keywords.

So, returns depend on discipline. If you’re investing in tech ccTLDs, keep these in mind:

Prioritize names with real startup usability

Stress-test renewal pricing and registry stability

Track aftermarket comps, not registration volume

Trend 8: SEO-Aware Domain Selection

SEO-aware domain selection applies whether you are buying a domain to build a business or to hold as an asset. A strong domain sits inside real search behavior. That gives you visibility from the start and preserves long-term value.

If you are buying a new domain to build

Start by understanding how your audience searches. The goal is to anchor your name in language that already carries demand.

With Bishopi’s Keyword Explorer, you can evaluate potential domains through a practical lens:

Choose trending keywords tied to clear user intent and high volume

Scan live search results to understand competition and ad activity

Select extensions your audience already trusts in that category

These checks align your domain with how customers discover businesses.

If you are buying a domain with resale in mind

Resale decisions add another layer: domain history. A domain carries a record of prior ownership and usage that shapes buyer confidence.

A focused review helps you protect future liquidity:

Examine ownership patterns and past site activity

Surface signals that affect trust and indexation

Confirm the keyword still maps to active commercial demand

SEO-aware selection connects both paths. Domains grounded in real search behavior perform as working assets today and retain value over time.

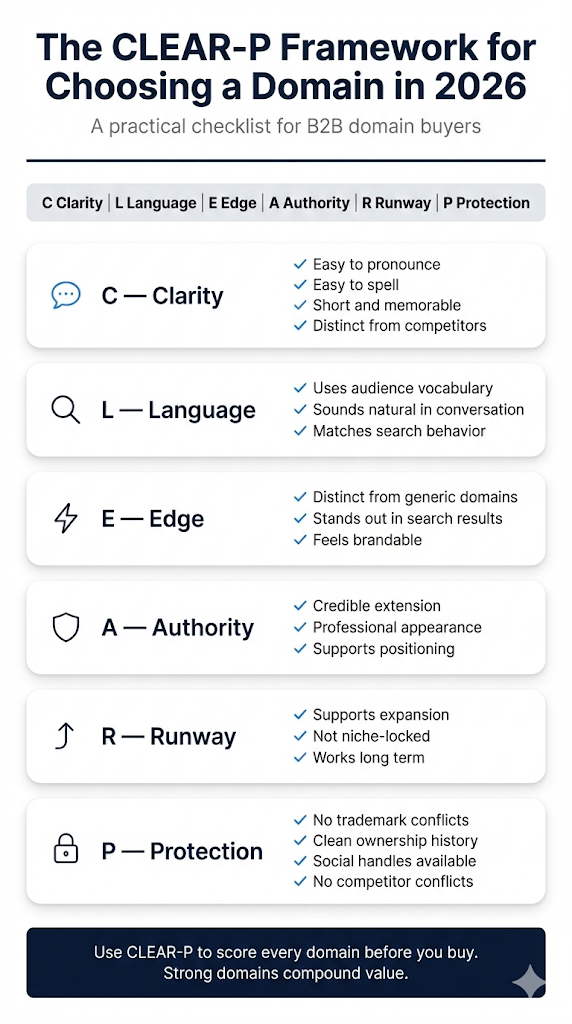

Effective Framework to Choose the Right Domain in 2026

We’ve created the CLEAR-P framework to make domain selection simple and structured.

It helps you quickly evaluate clarity, fit, competitiveness, credibility, scalability, and risk so you can choose a domain built to last.

[Infographic created via Google NanoBanana]

The Bottom Line

The 2026 domain market is separating into assets that carry operational utility and assets that rely on speculation.

The consistent winners share one trait: they reduce friction in how businesses acquire customers.

Local ccTLDs convert regional trust into traffic.

Tech extensions plug into startup formation.

SEO-aligned domains sit directly inside revenue funnels.

These forces are structural, not cyclical.

In a market with abundant supply, domains that function as acquisition infrastructure command the clearest premiums and the fastest liquidity.

Explore Bishopi’s domain valuation tools

FAQs

Which is the strongest domain name in 2026?

.com remains the strongest domain name because it carries universal trust and the deepest resale liquidity, especially for global brands. But .ai shows strong growth - it now holds roughly 3% of total market share and commands some of the highest average sale prices in the aftermarket.

Is .com or .io better?

.com is better for broad credibility and long-term authority, while .io works well for tech startups that want modern positioning and better name availability.

Why is .io so popular?

.io is popular because it offers short, available names and signals alignment with startup and developer culture, making it attractive for SaaS and tech brands.

Which TLD is best for SEO?

No generic TLD has an inherent ranking boost. .com, .io, and other gTLDs perform the same algorithmically. However, country-code TLDs can influence geographic targeting, and familiar extensions can improve click-through rates, which indirectly supports SEO.

Originally published at: www.bishopi.io

Get updated with all the news, update and upcoming features.