Domain valuation often fails its most basic test: consistency.

Run the same domain through multiple tools, and the output can vary by three or four digits. That gap creates hesitation, mispricing, and missed deals.

As a result, investors hold too long, founders overpay, and strong domains stall in portfolios because no one trusts the number on the screen.

The issue is not a lack of tools. It is a misunderstanding of what those tools measure, what they ignore, and where judgment must step in.

In this article, we show you how to value a domain name and why tools disagree. You'll learn how data, market context, and judgment combine to produce defensible pricing decisions.

What Actually Determines Domain Name Value

Truth is, domain valuation isn't simply a single number generated by algorithms. It is the sum of several measurable and market-driven metrics.

Let's look at the key domain value factors.

1. Structural and Intrinsic Value Factors

These are the factors that define the upper and lower bounds of a domain.

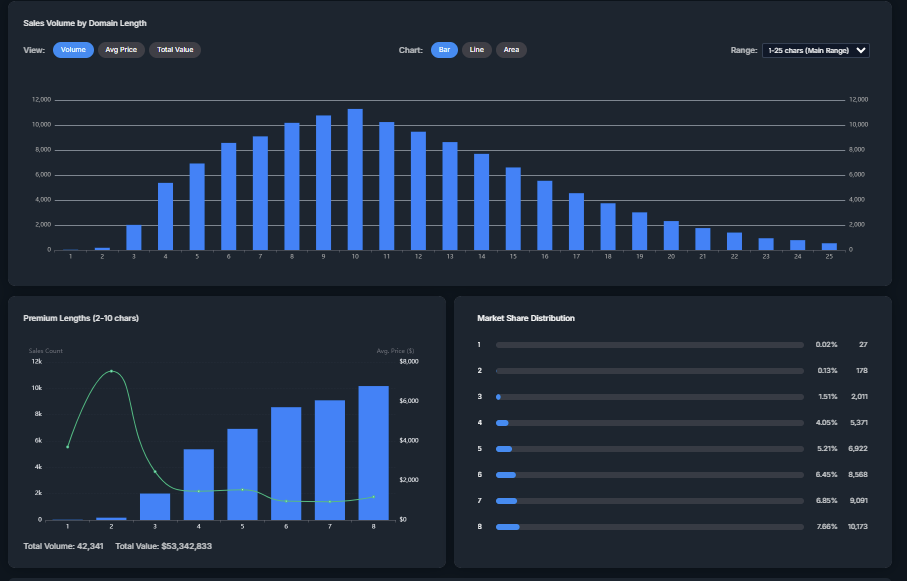

Domain length and memorability

Shorter domains are valuable because they reduce cognitive and operational friction.

Short only matters when the name makes sense.

A short domain that’s a real word, a familiar abbreviation, or easy to say and remember can be valuable. A short string of random letters usually isn’t, even if it’s only five characters long.

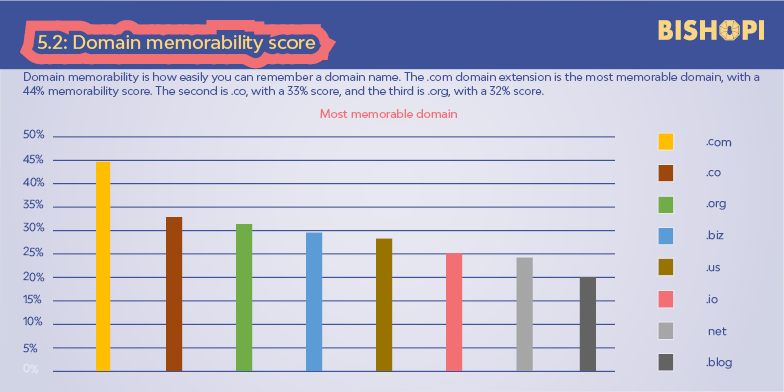

It also varies by extension. The .com TLD has the highest memorability, with a score of 44%. Here’s how that variability spans across other TLDs.

Compare these two domains: Zoom.com and ZoomMeetingsOnline.com. At a glance, the first domain is easier to recall and type, and is less prone to errors.

That usability translates directly into commercial appeal.

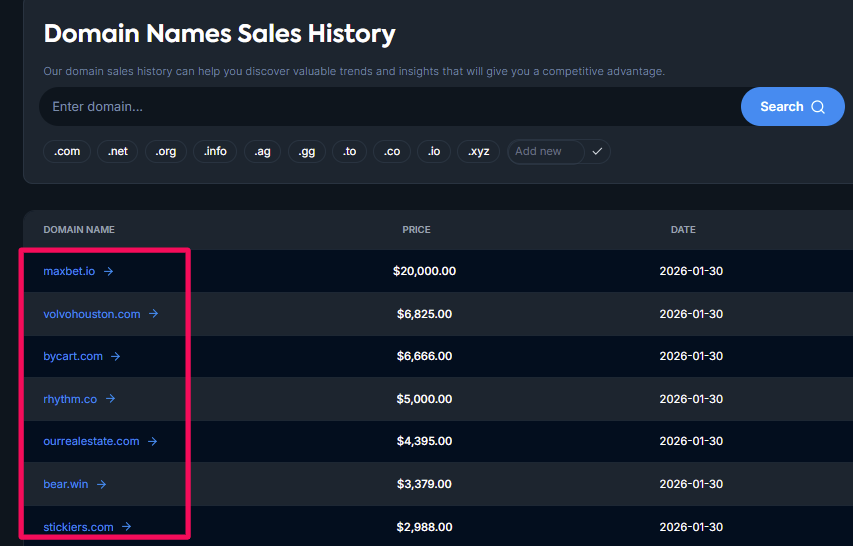

Take a look at the following 2026 data using this tool. Most of these domain name sales are short and memorable.

Domain Extensions and Market Trust

Domain extensions matter because buyers associate them with:

Credibility

Reach

Resale potential

In practice:

Other extensions, such as .io and .ai, perform well, particularly in tech or startups.

Niche or newer TLDs also work, but the buyer pool is smaller.

This January 2026 domain sales extract shows the .com TLD dominating.

Brandable vs Descriptive (Keyword-Led) Domains

Keyword-led domains directly describe what a business does. They appeal to users with a narrow use case and a clear domain monetization model.

An example is “OnlineCourses,” which clearly communicates the business intent.

Brandable domains are abstract, invented, or flexible.

2. Market and Demand Signals

Market signals define who wants a domain and why.

These signals include:

Buyer Intent and Commercial Relevance

A domain tied to a monetizable industry outperforms one that isn't.

Take, for example, a domain related to healthcare or finance. These usually attract business buyers.

In contrast, a clever name tied to a low-commercial hobby may be memorable but harder to monetize.

Industry Demand Cycles

Domain demand follows real-world trends. When industries expand, naming demand grows along with it.

This explains why some domains in SaaS, Fintech, and AI have recently seen a notable spike in interest.

An example is Fin.ai, which sold for $1 million.

3. SEO and Visibility Signals

Although SEO signals indirectly influence domain valuation, that effect is material.

In practice, search data serves as a proxy for demand, rather than a guarantee of future performance.

Here are the key search factors to consider:

SERP Competitiveness and Commercial Intent

SERP structure is often more informative than raw keyword volume.

When the top SERP is dominated by SaaS companies, marketplaces, or high-budget advertisers, it indicates commercial intent.

In contrast, SERPs dominated by informational content usually signal limited buyer urgency.

Exact-Match Domains (EMD) and Modern Search Reality

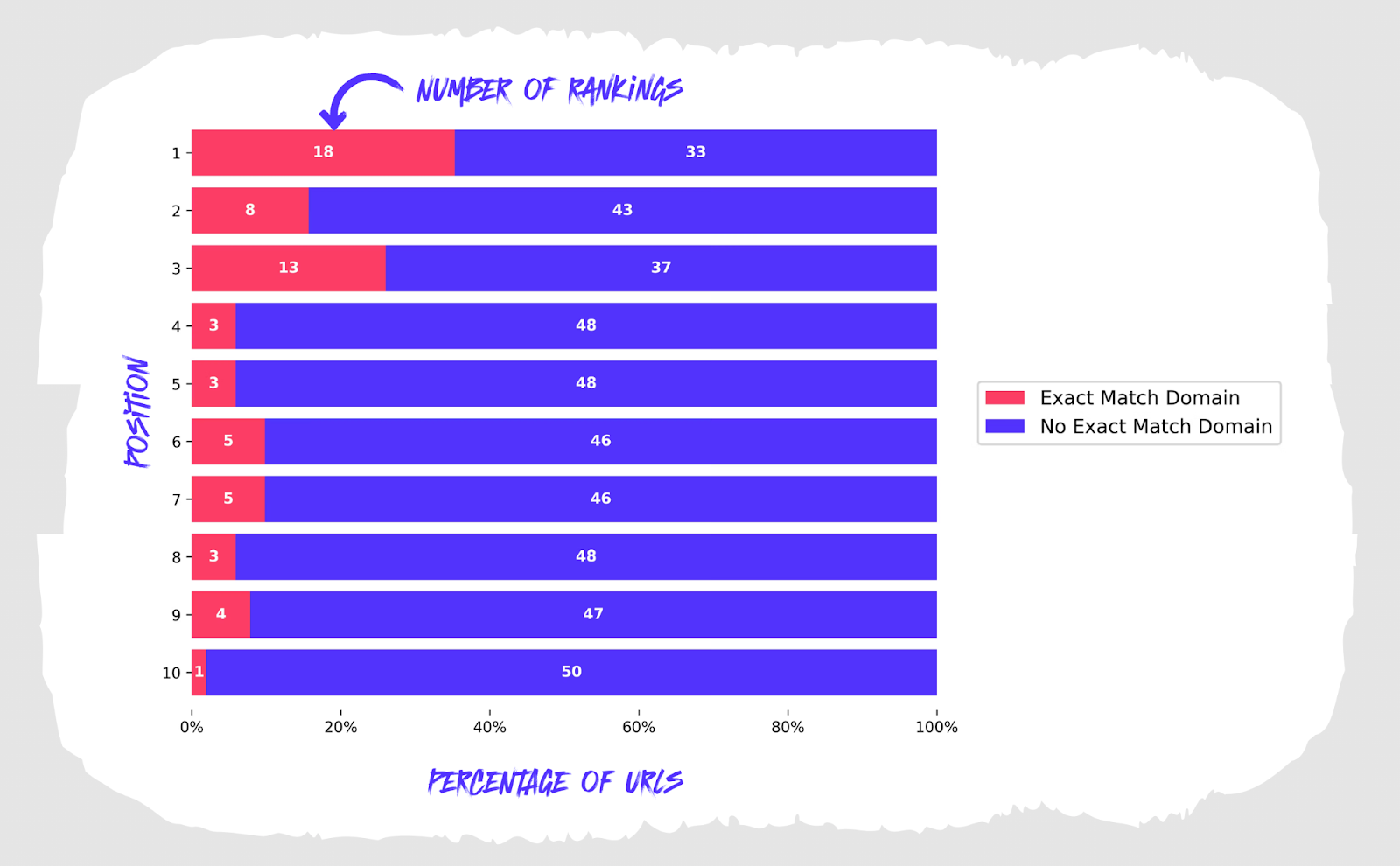

EMDs do not guarantee automatic ranking advantages.

This has also been Google's position that rankings are driven by relevance, quality, and context, not by domain names alone.

However, an SEO study shows that Google may still favor domains that match exact search queries.

Mark Williams-Cook, the founder of AlsoAsked, also holds this position. He reiterates that EMDs still work and can be used as a ranking shortcut.

Organic Potential vs Realized Traffic

A crucial distinction in valuation is the difference between:

Domains with actual traffic

Domains with theoretical traffic potential

Most valuation mistakes occur because people price situation #2 as if it were #1.

Why Domain Valuation Tools Often Disagree

Different domain name tools generate different values because they rely on different:

Data

Assumptions

Weighting models

Some tools emphasize historical sales while others focus on keyword signals or string rarity

Unlike Bishopi, tools like Estibot or Saw.com often return a single valuation number without showing you what drove it. You can’t know whether keyword trends, demand shifts, or market momentum influenced the price.

A Reddit discussion acknowledges this variability in tools.

Search data is also another source of variation.

Tools that treat search volume as value usually overprice domains

Tools that structure buyer intent more cautiously tend to be more conservative

Ensure you use AI-powered domain tools that analyze trends across:

Demand

Market behavior

Comparable outcomes

Pro Tip: Experienced investors often treat valuation outputs as directional ranges, rather than sale prices. So, valuation requires interpretation.

A Practical Framework for Domain Valuation

Here are the steps to follow:

Step 1: Baseline Valuation Using a Domain Name Valuation Calculator

Establish a baseline range using a domain name calculator.

Here, the aim is to establish whether:

The domain falls into low, mid, or high potential

The domain name is worth deeper analysis

You can compare outputs across tools to identify inconsistencies and outliers.

More advanced platforms, like Bishopi, add value here. They analyze trends across datasets rather than applying static formulas.

Step 2: Market Validation Through Comparable Sales

Next, validate the baseline using real market behavior.

You can use a domain name sales history tool to check:

Similar structure and length

The same or adjacent extensions

Comparable buyer intent and use cases

Step 3: Demand and Intent Analysis

This step lets you evaluate who the potential buyers are and how motivated they may be.

Analyze:

Commercial intent behind related queries

SERP framework and advertiser presence

Evidence of active companies operating in the category

Use this visibility data to infer buyer depth and urgency, not to directly assign value.

Step 4: Brand and Strategic Value Scoring

This is where you introduce judgment informed by data.

Ask yourself

Does the domain fit a credible business identity, or is it just a tradable asset?

How would the domain function in actual commercial use?

The output of this step does not yield a number. It is a confidence adjustment you apply to the valuation range you established earlier.

Human Judgment vs Automated Domain Appraisal

Automated domain appraisal tools are effective at processing data at scale. However, they do not replace judgment.

For reliable valuations, understand what each does well and where each falls short.

Turning Domain Valuation into Action

Valuation only matters if it informs a decision.

Once you have established a realistic range, choose how to act based on timing, demand, and risk tolerance.

When to Sell

It makes sense to sell a domain when demand is clear, and pricing power exists.

Look for these indicators:

Strong buyer activity within the category

Comparable sales closing consistently within your valuation range

Inbound interest from end users rather than investors

Ensure your domain pricing strategy reflects ranges and not point estimates:

When to Hold

Holding is a strategic decision, not indecision.

Here are the signals that support holding:

Emerging or expanding industries tied to the domain

Increasing buyer interest without pricing clarity yet

Structural strength that suggests long-term relevance

When to Develop

Development is justified when it:

Defines the domain’s use case

Indicates commercial intent

Attracts the right buyer profile

Use data to justify development, not optimism.

Monitoring Value Over Time

Use a domain monitoring tool to identify:

Changes in demand

New valuation opportunities or risks

Shifts in competitive intensity

Using Data and Judgment to Value Domains Smarter

Domain valuation becomes clearer once you quit searching for a single right number and start asking better questions.

Which signals matter here?

Where does demand actually come from?

What assumptions am I making without evidence?

A structured process brings those answers into focus. But this only happens when the data is connected, current, and interpreted in context.

That level of clarity is anchored in valuation signals, demand indicators, and market evidence that work jointly. Bishopi is designed to provide you with this analytical view.

The platform consolidates signals to help you make domain valuation decisions grounded in data and context.

FAQs

1. How is Domain Valuation Determined?

You can determine domain valuation by analyzing multiple factors.

These include:

Structural characteristics: length, extension, and brandability

Market evidence from comparable sales

Demand indicators tied to buyer intent

Strategic fit for potential end users

Valuation tools help you determine ranges. However, the final value depends on how these signals interact in current market conditions.

2. Why Do Domain Valuation Tools Give Different Results?

Domain valuation tools rely on different data sources, weighted models, and assumptions.

Some prioritize historical sales

Others emphasize demand or keyword signals

Others use static forms that do not account for changing market behavior

Therefore, interpret their outputs as directional estimates, rather than exact prices.

Originally published at: www.bishopi.io

Get updated with all the news, update and upcoming features.